702-660-7000

702-660-7000

Type: podcasts

Depending on your state, open enrollment for health insurance runs from November 1st through December 15th. Guest, Jesse Cheng from Take Command Health joins the show to share about using QSEHRAs (Qualified Small Employer Health Reimbursement Arrangements) and ICHRAs (Individual Coverage Health Reimbursement Arrangements) to provide tax-deductible benefits to employees in 2021 rather than trying …

Continue reading “HRA Benefits in 2021”

Read More...

Type: articles

Medical bills can become a hefty expense without the proper coverage. In fact, CNBC reports that in 2018, “the average American household spent almost $5,000 per person on health care.” Depending on your family size and health needs, health expenses can really start adding up. Despite our fleeting feelings of invincibility, we are all susceptible …

Continue reading “What Is Coinsurance? The Health Insurance Language Guide”

Read More...

Type: podcasts

🗓 Open Enrollment for Health Insurance starts Friday November 1st running through December 15th 2019. Special guest Jack Hooper from Take Command Health shares 2 new HRAs available for businesses in 2020 – ICHRA and EBHRA in addition to QSEHRA from 2017. Acronym Definitions: ICHRA = Individual Coverage Health Reimbursement Arrangement EBHRA = Excepted Benefits …

Continue reading “New Health Insurance Options for 2020”

Read More...

Type: podcasts

There’s a lot of “alphabet soup” 👀 surrounding HRAs (Health Reimbursement Arrangements), HSAs (Health Savings Accounts) and FSAs (Flexible Spending Accounts)…even people who are really smart managing money don’t always realize the potential of using these tools to save money. When it comes to HRAs there’s a traditional 105 HRA and also the QSEHRA which …

Continue reading “How You can Save More Money using HRAs and HSAs”

Read More...

It turns out that over 88% of Americans choose the wrong plan and end up wasting more than $500 a year. Before you sign up for a plan, it’s important to understand your options, understand the health insurance market and read the fine print. Here are a few tips from Take Command Health to help …

Continue reading “Open Enrollment Survival Guide: How to Shop for Individual Health Insurance”

Read More...

Type: podcasts

Many people are looking beyond traditional health insurance to faith-based healthcare sharing ministries. ⛪️ Not only can you stand up for the healthcare values you believe in, but you can often save money too. Since the Affordable Care Act requires health insurance to cover pre-existing conditions, traditional health insurance premiums have skyrocketed🚀 Participating in a …

Continue reading “Comparison of Healthcare Sharing Options”

Read More...

Type: podcasts

Open Enrollment for 2019 Health Insurance is just around the corner! (November 1st – December 15th 2018) Small Business Owners (up to 50 employees) have some great options to limit cost and help employees get the coverage to best fit their needs. No more hassle trying to make a one-size group plan to fit everyone …

Continue reading “How to Save Money on Your Health Insurance”

Read More...

Type: podcasts

Congress recently passed the biggest tax changes since 1986! In this episode, former IRS auditor Jack Cohen CPA shares what you need to know (for individuals and small business owners) about the new tax plan changes starting in 2018. Click the playhead above to listen now or read the transcript below. Optional Resources: 1. Call …

Continue reading “The New Tax Law Changes EP.148”

Read More...

Type: post

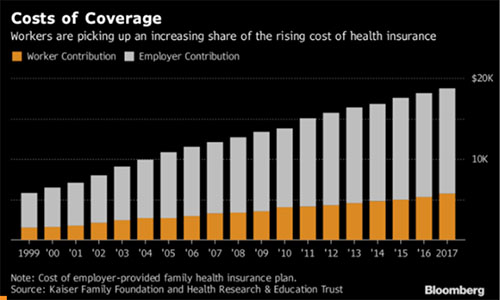

“The average worker in America is now shelling out $5,714 for a family health-insurance plan, 30% of the total $18,764 cost.”[i] Five years ago, workers shouldered (merely) $4,316 of the $15,745, or 27%.[ii] “Health care coverage has increased faster than wages and inflation.”[iii] And while congress and the president grapple with easing the pain of …

Continue reading “Affordable Health Care?”

Read More...