702-660-7000

702-660-7000

I had an opportunity to review a participating whole life insurance policy which had been in force for 11- years came across our desk for a review. The policy had been underwritten by a respected company that is known for good policies that can develop high guaranteed cash values as well as great dividends. But the affordability and comfortability of the premiums were not as favorable to the client as when the policy was issued. And so, the results of this particular review were quite interesting. But before sharing the results of this policy review with you, please listen to a story that will put this all into perspective.

I was out enjoying the wonderful experience of exploring the canyons and hills of southern Nevada on our ATV. I had topped a hill when suddenly my right front tire hit a bump while simultaneously my left rear tire fell into a rut. What happened next was NOT what I had intended. The ATV rolled and I went down on my left hip, while my body proved to be better-than-nothing padding for my passenger who landed on top of me. My hip was quite swollen and painful, painful enough that I knew I needed to get an x-ray examination to make sure the bones were stable and not cracked or fractured. Fortunately, everything was intact, my femur (hip bone) was stable and capable of sustaining my full weight.

Now back to life insurance.

Participating Whole Life Insurance can provide a lot of stability, sustainability and enjoyment when used as a custodian of your hard-earned money.

But when a policy has not been engineered with your best interests in mind it can throw you just as hard as I was thrown, or even harder. That is why it behooves everybody to know where the bumps and ruts can occur in the future at the time you purchase a life insurance policy, or if not then, during a review before that policy gets far enough along for the damages to become insurmountable. Knowing what lies ahead can prevent you from having to navigate through unknown rough and rugged terrain, thus permitting you to relax and enjoy the wonderful experience of stability and sustainability that owning participating whole life insurance can provide.

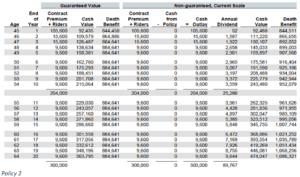

This particular participating whole life policy that was brought in for review, will be 11 years old at years end. The premiums that will have been paid into this policy by then will be $188,430. The Guaranteed Cash Value at that time will be $124,276, and the Guaranteed Death Benefit will be $1,465,997 (see Policy 1.) This means that Policy 1 is guaranteed to have $64,154 less cash value than what has been paid in premiums (Total Premiums Paid $188,430, minus Total Cash Value $124,276.)

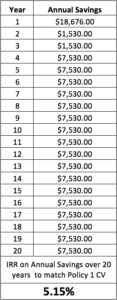

Now compare Policy 1 with Policy 2. Policy 2, in its first year, has higher Guaranteed Cash Value compared to total premiums paid, than what Policy 1 has in year 11 (same calendar year as year 1 of Policy 2 if a 1035 exchange[i] is completed this year.) Notably, the Total Premiums Paid for Policy 2 will only be $105,600 by years end (the Surrender Value of Policy 1 less $18,676) while the Guaranteed Cash Values will be $92,435. That is only a $13,165 difference between Total Premiums Paid versus Guaranteed Cash Value, instead of a $64,151 difference as noted in Policy 1, end of year 11. This is a significantly large enough difference to make Policy 2 more favorable over Policy 1 because the client will have an additional $18,676 in his pocket due to the exchange, and, it will allow the client to use that money to create greater value elsewhere besides paying insurance premiums. Statically, he will only have to earn 5.16% on this saved capital to have a better return on his money than if he kept on paying premiums into Policy 1.  (See Illustration 1.)

(See Illustration 1.)

Astutely, you may have noticed, as did the client, that his death benefit was smaller in Policy 2 than it was in Policy 1. This was concerning to him and rightfully so. Yet down the road, 20-years from now, the client will have spent $213,900 less on premiums for Policy 2 than he would have paid for Policy 1. But if he purchases a term insurance policy (see Policy 3), to make sure he has the same or better coverage than Policy 1 would have provided him, he’ll still end up saving $196,300 on premiums + the $18,676 that he received back tax-free from Policy 1. This is because, a 20-year guaranteed convertible term policy costs a mere $880 per year, something that is completely affordable and comfortable for this client, especially knowing he’ll save nearly $215,000 ($18,676 cash back from Policy 1 + $196,300 in saved premiums over the next 20-years = $214,976) by following this plan. And, noteworthy enough, he’ll end up with more Death Benefit over the next 20-years, than if he had continued with Policy 1.

It shouldn’t be overlooked, that the client can convert Policy 3 (the term policy), into participating whole life insurance without any additional proof of insurability whenever his cash flow makes such a conversion both comfortable and affordable for him to do so. And in doing so, he won’t have to worry about any hidden tax consequences, hassles or liabilities that would make such a conversion NOT in his best interest. Furthermore, his option to convert Policy 3 into participating whole life insurance, remains until year 19 without him losing any of his additional $625,000 of term coverage.

Here, someone might say, that down the road in another 20-years Policy 1’s Total Premiums Paid represent only 81.58% of the Guaranteed Cash Values while in Policy 2, Total Premiums Paid represent 82.46% of the Guaranteed Cash Values. Still, the saving of nearly $215,000 over the next 20-years remains highly significant, particularly because this client has secured the life insurance coverage he needs during that time period. Finding somewhere that he can makeup, or even make more than this slight difference, should not be difficult for this client, or anybody for that matter, who desires to do so, (see again Illustration 1.) Thus, his savings provided in Policy 2 and 3 merely allow the time value of money to work more efficiently and beneficially for him.

| Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

Of course, just as with my hip injury when an x-ray was needed to ascertain what action was best to take, a second opinion could prove that a 1035 exchange might not be in the client’s best interest. And that is exactly what the insurance companies provide for by allowing the agent who designed the first policy to review the case and give their opinion as to the feasibility of any 1035 exchange. Which leads me to comment that the Urgent Care physician who ordered my hip x-ray was not a radiologist. And as a trained chiropractor, I was better equipped to read my own x-rays than he was.

It was obvious upon seeing the films that there were no fractures or complications that would prevent me from continuing to walk on my hip. However, the physician that evening sent my x-rays to a radiologist for his report. The report came back in about 15-minutes and it was negative. But, as I read over the radiologist’s report it was about someone’s foot not my hip. Palpably, that x-ray report did not pertain to me or my injury and fortunately I had already seen the x-rays and knew what I needed to do.

But like the radiologist in the case of my hip injury, the agent who wrote and sold Policy 1 to this client nearly 11 years prior, was given opportunity to review the 1035 recommendations. His reasons for not going through with the 1035 exchange were not only colorful but as invalid as the radiologist’s report was concerning my hip. The writing agent for Policy 1 warned the client about the “devastating effects” such an exchange would cause him financially. He attempted to scare the client by stating, “You will be faced with new fees, charges and because you are starting over again, your long- term growth in the policy will be compromised. In my many years of practice, I have never replaced any existing whole life policy because it is in the client’s best interest to leave it alone. My primary goal is for your best interest and any agent who would do a 1035 exchange is blatantly looking out for their best interest not yours. They obviously are concerned only with the commissions they will earn! I can prove that because I have spoken with the replacing insurance company[ii] and they agree with me.”[iii]

Intriguingly, this agent has some valid points despite his use of scare tactics.

That being said, all of these points, and specifically the affordability and comfort of the current premiums required on Policy 1, were mindfully considered before the 1035 exchange was recommended to this client. Taking such due diligence, much like reading an x-ray, allowed this client to select a better financial option for his premium payments. The option he chose was to complete the 1035 exchange instead of continuing to pay the costlier premiums of Policy 1. Once cognizant of the possibilities, he was delighted to complete the 1035 exchange, because he also was more aware of his own affordability and comfortability than his former agent was. And of course, saving nearly $215,000 over the next 20-years, was undoubtedly a motivation. Now this client is happily saving money, enjoying the fact that he owns a stable and sustainable product(s) that will take care of his liabilities while still providing him with the free cash flow he needs to create more value than if he continued making the higher premium payments to Policy 1.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Not everything is black and white enough in life to emphatically say never. And therefore, we don’t make blanket statements about never replacing participating whole life insurance at McFie Insurance because, as in this case, we would have been culpable of encouraging someone to throw away both opportunity and money by making such a broad-based statement like that. Remaining open and examining all the facts, exactly like what is required when examining an x-ray, will ensure that the final report matches the patient’s presenting complaints and needs, prevents unnecessary discomfort, and prevents no little amount of embarrassment.

If you are considering the purchase of a life insurance policy, have already purchased a policy or know somebody who has or is considering purchasing a life insurance policy, we would be happy to help you with a policy review to make sure that such a policy truly represents the best interest of the policy holder/owner/beneficiary(s). After all, an x-ray report on someone’s foot is of no benefit for someone who needs to know if they have a hip fracture. By providing this service to you and your friends and family, we hope to earn your respect, trust and future business as well as save you a lot of money.

[i] A 1035 exchange uses the Surrender Value (i.e., cash value) from one policy to purchase insurance (either paid up insurance, base insurance or both) in another policy. In this case $105,600 of the Surrender Value from Policy 1 was used to pay base insurance premium and paid up insurance into Policy 2 for the first year. This left an additional $18,676 on the table for the client to use without tax penalties as his premiums paid for Policy 1 were greater than his Surrender Value at the time the 1035 exchange took place.

[ii] Name omitted for privacy concerns

[iii] Letter from agent who sold Policy 1 to client nearly 11-years prior to this review. It must be noted that a replacing insurance company can’t legally speak to anyone regarding the client’s application for 1035 exchange except the client and/or the agent recommending the 1035 exchange. The original writing agent of Policy 1 has a history of his license being revoked in one state and he has faced fines and penalties in other states for his dishonesty, so it wasn’t surprising to find half-truths and outright lies in his letter to this client.

Dr. Tomas P. McFie

Dr. Tomas P. McFie

Most Americans depend on Social Security for retirement income. Even when people think they’re saving money, taxes, fees, investment losses and market volatility take most of their money away. Tom McFie is the founder of McFie Insurance which helps people keep more of the money they make, so they can have financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.