702-660-7000

702-660-7000

The entire concept of Becoming Your Own Banker is based on capturing the money lost when you finance something. Of course, we finance everything we purchase in life by losing the interest we could have earned when we pay cash, or by paying interest to others when we borrow to make a purchase. Outrageously, we even lose interest on money we save when we don’t earn enough interest to overcome the cost of inflation.

Today Americans are spending more money on interest than at any other time in our history. Credit card interest payments alone were $122 billion in 2019, which is 50% more than the credit card interest which was paid in 2014. Nelson Nash wanted to stop this blood bath in his own life back in the early 1980’s and was able to do so by using participating whole life insurance (PWLI) contracts into which he was paying premiums.

PWLI contracts guarantee the policyholder money paid into the contract will not disappear but will be there when it is needed. Unlike bonds, stocks, mutual funds, EFTs, real estate, etc., PWLI contracts provide the policyholder with certain guarantees which are not found anywhere else in the financial world.

Consider this. When a dollar is spent at age 20 and that dollar could have earned 1% annually, then by age 67 (retirement age) 60% has been lost of what could have been yours. If that dollar could have earned 5% then 47 years later, 890% of what could have been yours has been lost. Yet, in certain specific PWLI contracts, the policyholder won’t lose all that growth when money is used to finance a purchase. This is because specific guarantees are provided in these contracts when they are designed properly by a knowledgeable agent. At McFie Insurance, we specialize in designing these kinds of PWLI contracts for you.

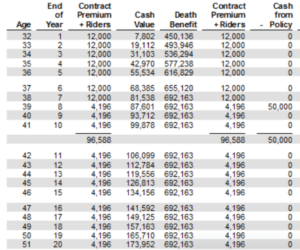

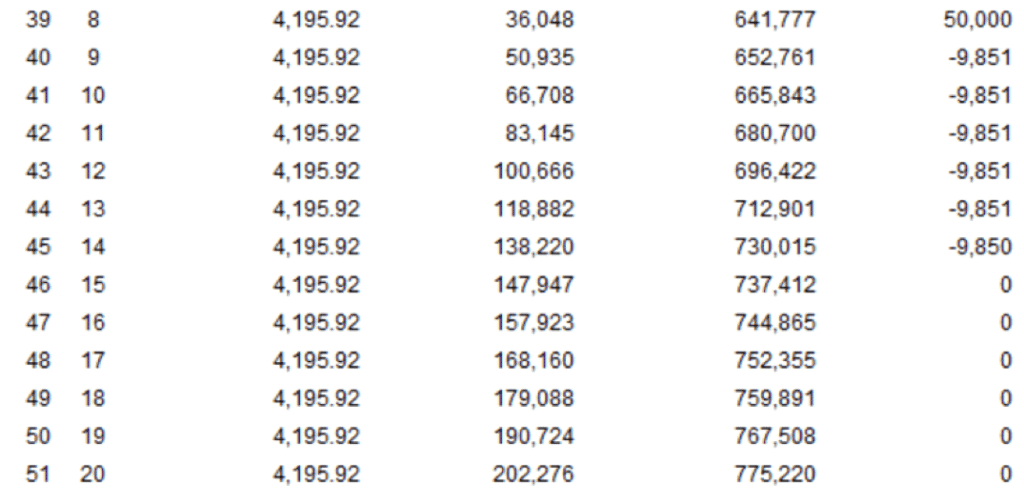

A policy loan taken from a PWLI contract in year 8 (see attached illustration) does NOT alter the guaranteed cash value growth in the following years. This means the guaranteed growth in the policy is not hindered by a policy loan.

A policy loan taken from a PWLI contract in year 8 (see attached illustration) does NOT alter the guaranteed cash value growth in the following years. This means the guaranteed growth in the policy is not hindered by a policy loan.

Yet, when the loan is repaid, instead of the interest paid on the loan being diverted to stockholders of some bank, credit card company, or other financial institution, it goes back to the insurance company. PWLI contracts provide for these extra profits made from policy loan interest, to be shared with the policyholders. This feature in PWLI contracts keeps the policyholder from losing all the interest paid on a policy loan and can actually increase the profits of the insurance company and thus enhance the dividends the company shares with the policyholders.

In this case, the policy loan repayment for the $50,000 extends for 6 years, at $9,851 a year. This helps create an increased cash value of $28,324.000 compared to the guaranteed cash value (see year 14). As total interest paid for this loan was only $9,105, borrowing $50,000 from this policy and repaying this loan at 5% created a profit instead of a loss.

In this case, the policy loan repayment for the $50,000 extends for 6 years, at $9,851 a year. This helps create an increased cash value of $28,324.000 compared to the guaranteed cash value (see year 14). As total interest paid for this loan was only $9,105, borrowing $50,000 from this policy and repaying this loan at 5% created a profit instead of a loss.

Borrowing $50,000 from any other source would have had an interest cost as well, but the principle paid on the loan would have been transferred to the third party hosting the loan instead of being returned to the purchaser to use over again. In a PWLI contract the principal paid on the loan restores the exact same amount to the available cash values that can be leveraged and used again. Furthermore, with PWLI contracts the interest paid on policy loans bolsters the dividends the insurance company can afford to pay to their policyholders. As dividends are what helps defer, and eventually overcome, the cost of policy loan interest, it makes sense to use PWLI contracts to overcome the cost associated with financing.

When it comes to thwarting the cost of inflation, PWLI contracts have a guaranteed level (fixed) premium which can NOT increase for the entire lifetime of the contract. Yet, as can be seen, the cost of the policy is less than the guaranteed cash values by year 9 in the attached PWLI illustration. Due to inflation, every year the premium is paid, the value of the dollar used to pay that premium is less than it was when the contract was initiated. Even so, the cash value growth each year after the guaranteed cash values exceed the cost basis (year 9), the annual growth on the premium paid increases by a much greater rate than the average rate of inflation for that particular year. For example, in year ten the cash value growth is guaranteed to be $6,166 which exceeds the annual premium cost of $4,196 by $1,970. By year twenty, the guaranteed annual cash value growth for the year is $8,242 while the guaranteed premium has remained fixed at $4,196, making the annual return on premium paid in year twenty, 96.425%.

Inflation has been growing annually for years. 1918 saw inflation rates average 18%, 1947 inflation rates were 14.4% and 1980 inflation rates averaged 13.5%. Overall, historical inflation rates have averaged 2.46% annually a cumulative inflation has cost every American 102.40% since 1990. Having a PWLI contract which naturally hedges against this 102.40% inflationary loss, due to the fixed premium and guaranteed cash value growth, helps restore some, if not all, of the purchasing power of a policyholder’s dollar which otherwise would be totally lost to inflation.

At McFie Insurancewe design, sell, and teach people how to keep more of the money they make using PWLI contracts. Paying more for a PWLI contract than you need to will end up preventing you from keeping more of the money you make. Call us so we can help you keep more of the costs associated with interest, principal, and inflation.

Dr. Tomas P. McFie

Dr. Tomas P. McFie

Most Americans depend on Social Security for retirement income. Even when people think they’re saving money, taxes, fees, investment losses and market volatility take most of their money away. Tom McFie is the founder of McFie Insurance which helps people keep more of the money they make, so they can have financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.