702-660-7000

702-660-7000

The headlines blared: “Woman saves $7,800 a year on grocery items by couponing.” But what does that really mean?

A South Carolina native recently was written up for her frugality, having cut her weekly grocery shopping bill from $200 per week down to only $50 per week, due to her couponing. Inspired by the TV show Extreme Couponing this woman spends Monday through Friday chasing coupon bargains all over town. In fact, she says she travels more than 300 miles per week to accomplish this savings. On the low side, that’s 15,600 miles a year!

Knowing that the average cost of driving a car is 60.8 cents per mile that means this woman spends more on driving that what she saves on groceries. Multiply 300 miles per week by 0.608, then by the number of weeks in a year, 52, this comes to $9,484.80. Even an electric car would cost, on average, $8,469 for these kinds of miles traveled.

That being said, this woman does work weekends at the Red Lobster waiting tables. According to the US Bureau of Labor and Statistics, the average income per hour for a restaurant like the Red Lobster is $11.73 per hour, including tips. Which means, working another 13 hours a week would make her more money than she is “saving” by chasing coupon bargains hither and yon. Ah, but it wouldn’t be free.

Today, many people look for bargains on the things they purchase. And there is nothing wrong with getting a good deal and not paying more than you need to pay. But often bargain shopping comes down to the dog chasing its own tail.

It has been said that everyone today knows the price of everything but the value of nothing. And that certainly applies to bargain hunters. There comes a point when your time, your effort and the wear and tear on you and your current relationships, as well as current assets and capital, is worth more than trying to save a few more pennies.

Years ago, we became fascinated with a newsletter entitled The Tightwad Gazette. But it didn’t take us long to realize that chasing all over town to save a dime cost us more than paying a dime extra for the same product which was just down the street.

Shopping around for your life insurance could also become more-costly than you realize. Yes, you should never pay more for your life insurance than you absolutely have to pay. But delaying the actual purchase once, you realize that you need to make that purchase, can end up costing you more than what you can actually save by extending your shopping experience.

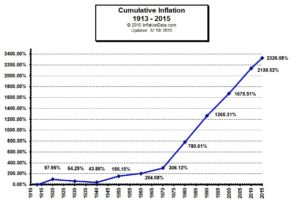

The time value of money clearly proves that when your money is not compounding in your favor, then its value is being destroyed. Inflation has been roughly 3.22% on average since 1913 when the Federal Reserve took over our US currency. But the value of your dollar due to that inflation rate is devastating. A 1913 dollar purchased 2,326 more than what a 2019 dollar can purchase for you today.

The time value of money clearly proves that when your money is not compounding in your favor, then its value is being destroyed. Inflation has been roughly 3.22% on average since 1913 when the Federal Reserve took over our US currency. But the value of your dollar due to that inflation rate is devastating. A 1913 dollar purchased 2,326 more than what a 2019 dollar can purchase for you today.

Your take home message is:

1. Be sure to shop around, but don’t allow “paralysis of analysis” to destroy the value of your future dollar.

2. Always consider the time value of money and the value of your time. Your time can be more valuable than the money you save.

3. Never pay more for your life insurance than what you have to pay. Realize that some policies cost less up front than others, but over time they can end up costing you much, much more. Always consult with a trusted advisor to see if you are getting what you believe you are getting.

4. Don’t believe that a bargain is a bargain unless you know the quality of the product you are purchasing. Just because the offer says you’ll save money doesn’t mean you will.

5. Finally, relax. Life is much too short to always be fretting over whether or not you paid the lowest price.

In the long run, time is more important than saving an extra dime. You can always make more money, but you can’t make more time. It just isn’t possible.