702-660-7000

702-660-7000

There is a lot of noise being made surrounding what and what isn’t going to happen to your taxes under the GOP Tax Bill. But one thing is for sure, taxes won’t be going away, because as Benjamin Franklin noted years ago, death and taxes are two things you can always rely on.

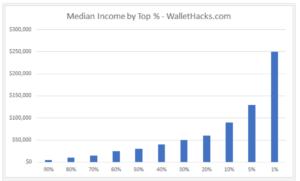

But concerning the new tax bill, some are reporting that it won’t reduce taxes for those with lower incomes. And that is simply not true any way you look at it. First of all, the new tax bill nearly doubles the standard deduction, which is the amount of money you earn before any taxes are owed. And beyond that, there are other tax advantages to deliberate. For example, take someone who is in the top one-half of wage earners in the United States. (By the way, that means they earn at least $30,000 annually.)[i] The new tax bill will lower their taxes by a whopping 20.3%![ii] So, let’s stop all the noise about how this new tax bill won’t help lower-income workers by decreasing the amount of taxes they have to pay.

But then there are the noisemakers who complain that the rich will get a break on their taxes and how unfair that is to the poor. Well, the facts are, that those earning $269,000 or more annually will have a tax increase of at least 10.7%! So only the crazies are still screaming that this new tax bill is a tax bill designed and written to protect the rich and stick it to the lower income taxpayers.

Of course, others are bemoaning the fact that this new tax bill is designed for corporations because corporations are getting such a huge tax break on capital gains and retained earnings. And this is absolutely true even though there is nothing to moan about it and many things to rejoice over because of this huge tax break provided to corporations. What these corporate tax reductions really accomplish has to be considered. Lowering corporate tax rates will;

A. Let corporations spend more on

B. Incentivize corporations to stay local

None of these by-products of lower corporate taxes is bad news because they all strengthen and expand the American economy where we all have to live and survive. And ultimately, what is good for America is good for the entire world because the United States provides so many goods and services that simply cannot be provided by anyone or any other country.

Here’s the bottom line regarding all the noisemakers who are creating the racket about how unfair the new tax plan is. Refusing to accept logic, they reject the most basic economic principle by declining to think in percent. This they do because by focusing on dollars and cents, instead of percentages, they can stir up distrust and cause confusion, as money and cents are not a true mathematical representation of what is going on. Here is an example:

A wage earner making only $25,580 will save a mere $372 on their taxes under the new tax bill while someone earning $116,320 will save $953, which is nearly 3x the tax savings.

Yet what they won’t tell you is, this same $25,580 wage earner will save 20.5% on their current tax bill while a $116,320 wage earner will only save 5.2%. And that means this lower wage earner will save 15.3% more than the higher wage earner will save!

This exercise in thinking in percent is the only accurate way to compare the results of any financial plan, not just your tax savings under the new tax bill. Too often we are tempted to think that paying a small fee to a money manager to manage an investment portfolio is tolerable because the percentage is so small. Yet a minor 2% fee paid to your money manager can reduce your overall life-time growth by 80% and that is not such a small number to lose. When we do not comprehend the value of thinking in percent we lose! And that is one reason nearly 90% of retirees in American (that is 1 out of every 9-retired people in the United States) depend on Social Security in their retirement.[iii]

Another detail to consider is the percentage that you must earn back to offset a financial loss or market correction.

| Loss | Must Earn |

| 10% | 11% |

| 50% | 100% |

| 80% | 400% |

By thinking in percent, you will realize that assuming risk is not something that anybody at any age should be eager to expose themselves to. One market correction could take years for you to recover what you had gained. Matter of fact, by thinking in percent, saving more will become more important to you than the rate of return you can earn. This is because the more saved the more you will benefit from compounding.

In fact, thinking in percent will allow you to see how smart it is to save the money this new tax bill provides for you, instead of watching it disappear as all money does if there isn’t a plan to do otherwise. And, as just mentioned, saving more today allows compounding to work more for you, permitting you to benefit from a far greater percentage down the road when you can no longer work as long and as hard as you are working today.

So, how much more are you going to save because of the new tax bill? 5%, 10%, or maybe even more! And where are you going to save that money? In a guaranteed place? Or someplace where you’ll have to assume a risk of a market correction and find yourself forced into starting all over again? Remember this. It will take nearly 25 years for a person savings $500 a month, earning 10% to earn as much as a person saving $1,000 a month earning a mere 5%. And if that 5% is guaranteed, then the person earning 10% while facing random market corrections, annual fees, taxation and other risks, may never, ever match the earnings of the one saving more money, even though the guaranteed interest rate is 50% less.

Thinking in percent, is a valuable means of protecting yourself from all the noise makers today regarding the new tax bill. But it will also be a guiding light for you to follow as your take the steps necessary to ensure your future financial sustainability.

[i] https://wallethacks.com/average-median-income-in-america/

[ii] http://www.businessinsider.com/trump-tax-plan-senate-take-home-pay-changes-every-income-level-2017-12

[iii] https://money.usnews.com/money/retirement/articles/2011/08/30/retirees-increasingly-depending-on-social-security