702-660-7000

702-660-7000

It’s no secret that your odds of becoming part of the wealthiest 1% in the world is reasonably achievable, as one in nine Americans accomplishes that every year.[i] However, you have less than a 2% chance of remaining in that top 1% tier for more than 5 years and less than a 1% chance of …

Continue reading “Your # 1 Threat to Building Sustainable Wealth”

Read More...Type: page

Welcome to the Learning Center Browse by Topic, Media Type or Search The Perpetual Wealth Code The Perpetual Wealth Code™ is a financial strategy based on time-tested principals and wisdom that you can apply to become a wise money manager and create more wealth. The 10-20-70 Rule is part of the Perpetual Wealth Code Strategy …

Continue reading “Learning Center”

Read More...

The biggest financial fear many people have is that they will run out of money.[i] Not only are returns shabby, at best, but human lifespan has gradually been rising. This is not a good recipe for being able to retire care free on the money you’ve put away during your career. But even with what …

Continue reading “Annual Returns… The Trickiest Illusion of All”

Read More...

Type: post

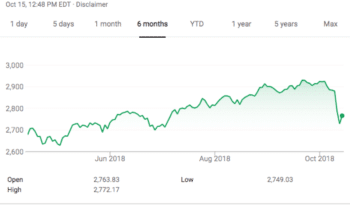

Ouch! The market had a hiccup last week giving up nearly all the gains it attained over the summer. Now, maybe you don’t have enough in the market to worry about that hiccup or maybe you have enough invested that you now feel you need to hold on until this market recovers and you regain …

Continue reading “How to Protect Your Gains”

Read More...

Type: videos

Why invest your money with the “Bankers” and let them risk it all, when you could be using the same powerful tool that they personally use to protect their own money?

Read More...

Type: post

The cost of college is rapidly growing. According to Forbes, the “price of college is increasing almost 8 times faster than wages.”[i] And to make matters worse, educational loans have become the largest block of debt, behind housing, that exists in American today. Statistics gathered by the College Board,[ii] show that the average debt assumed …

Continue reading “Overcoming the Cost of College”

Read More...

“Fear of running out of money before you die” is the biggest fear that Americans face today, behind terrorist attacks and government corruption.[i] And yet, for pennies on the dollar, you can overcome that fear and gain confidence about your financial future. More and more people believe the deck is stacked against them, and that …

Continue reading “How to reduce the cost of your mortgage to $16/month”

Read More...

Recently, Dave Ramsey was busy bashing life insurance again. It must be pretty dull having to pick on the same subject all the time, without having any facts to back up your opinion. Anyway, Dave mentioned that life insurance was too costly to maintain. Ramsey also says there are better places to invest your money, …

Continue reading “Are You Sure You Should Pay Your House Off Early?”

Read More...

The story about the Ugly Duckling who turns out to be a beautiful Swan always intrigued me as a child. Perhaps it was because that, even as a child, it was obvious to me that we are too quick to judge things as they appear, rather than as they really are. This applies to investing …

Continue reading “The Ugly Duckling or The Black Swan | The Greatest Investment of All Times”

Read More...

Type: videos

Growth of Student Loan Debt over the past decade has been 212.5% greater than wages! This means that a student working a part-time job and earning minimum wage in 1987 could pay for 106.5% of their college expenses. However a student working a part-time job and earning minimum wage in 2016 could only pay for …

Continue reading “Student Loan Debt Solution”

Read More...