702-660-7000

702-660-7000

Type: podcasts

In the Studio, Tom and John McFie talk about Business Financing, and how Savings is the building block to success with your finances… Tom shares about how before he discovered the Perpetual Wealth Code™ he always believed in saving but didn’t know how to save so it profited him instead of the Money Managers, Banks …

Continue reading “Business Financing EP.5”

Read More...

Type: podcasts

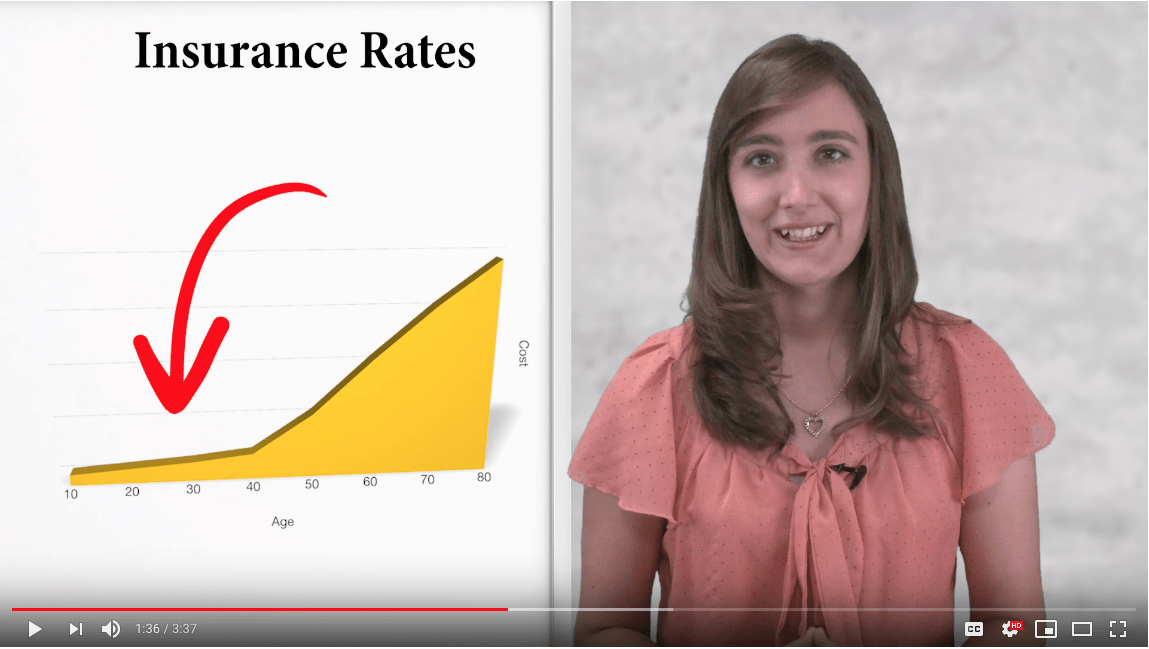

Tom and John McFie talk about Universal Life, Variable Life, Indexed Universal Life, Whole Life Insurance, Equity Indexed Universal Life, Term Life Insurance, and Participating Whole Life Insurance. John shares how the policies are structured and Tom McFie shares his wisdom from years of experience in the Financial Arena. In this episode, you will learn …

Continue reading “Universal, Variable and Whole Life Insurance EP.4”

Read More...

Type: podcasts

Tom and John McFie talk about Cash Value life insurance and The Perpetual Wealth Code™. They talk about common financial myths and certain things to be cautious about with your finances.

Read More...

Type: podcasts

Dr. Tom and John McFie talk about risk, and how Taxes and Fees destroy the earnings on your money by more than many realize… That is why the Banks purchased over 143 billion Dollars of Life Insurance in 2013, which is now up to over 146 billion in 2014. Money has to flow to make …

Continue reading “Diet and Insurance EP.2”

Read More...

Type: podcasts

Tom and John McFie talk about Retirement and Qualified Plans, and what is happening to American’s savings, Social Security, and Retirement. So what should people do to avoid this? Asks John. Tom shares the Financial Solution that creates Wealth, Money and Freedom that he discovered when he was 45 years old. Transcript: Tom: Welcome to …

Continue reading “Retirement and Qualified Plans EP.1”

Read More...

When should I purchase my next Life Insurance Policy? Large Participating Whole Life Insurance policies are great tools to have working for you. But only if the premiums are comfortable and affordable to you. Something else to keep in mind are the IRS rules which regulate how much money you can put into a policy …

Continue reading “Should I own multiple policies or just one big policy?”

Read More...

Dr. Seuss’ book, “The Sneetches,” which is also now a YouTube, is about two different kinds of creatures. One type has stars on their belly, the other kind have no stars. Of course, those who have the stars make those who don’t have stars feel inferior and less of a Sneetch than those who do. …

Continue reading “The single biggest mistake people discover after taking a policy loan”

Read More...

Type: videos

Secure Financial Foundation The most critical piece of your financial plan is the foundation. If you get a sturdy foundation, everything you add has increased reach and effectiveness. We recommend and sell Participating Whole Life Insurance for this because: It builds equity It’s not effected by the market Premiums never go up Click here to …

Continue reading “How to Build a Secure Financial Foundation”

Read More...

Type: post

In a recent public opinion poll, people we’re asked, which they would prefer; Have $10 million dollars in the bank along with fame, or Have $50 million dollars in the bank and retain their anonymity?[i] Unexpectedly, for the author of this study, 97% of those who participated in the survey picked being rich and remaining …

Continue reading “Rich or Rich and Famous?”

Read More...

Laddering with Whole Life Insurance and Term In the financial world, laddering refers to when you stagger something like a CD maturity date, and you buy some that mature short term, some mid term, and some long term. This allows you to have an influx of cashflow over a period of time rather than all …

Continue reading “Laddering with Whole Life Insurance and Term – The Good the Bad and the Ugly”

Read More...