702-660-7000

702-660-7000

Table of Contents: Can I Borrow From My Life Insurance Policy? When Should You Take a Life Insurance Policy Withdrawal? Tax Ramification of Life Insurance Policy Withdrawals How Life Insurance Policy Loans Work: How to Take a Policy Loan Why You Should Take a Policy Loan Pros and Cons of Taking Out a Life Insurance …

Continue reading “Life Insurance Policy Loans and Withdrawals – how and when to use them”

Read More...

Investment grade life insurance is commonly sold as a solution to avoid the non-diversifiable market risk associated with investing in the market. The problem is that investment grade life insurance is essentially a marketing gimmick. Here are the reasons why: Life insurance is not an investment.[i] An investment requires you to assume risk.[ii] Life insurance …

Continue reading “Investment Grade Life Insurance: What You Need to Know”

Read More...

The term life insurance you secured when your children were young plays a pivotal role in your financial protection, offering financial security at a cost-effective rate. But, these policies are intentionally designed for short-term coverage. If you outlive the policy’s duration, your beneficiaries receive no death benefit. Term insurance might suffice for your family’s needs. …

Continue reading “Pros and Cons of Converting Term to Whole Life Insurance”

Read More...

Type: articles

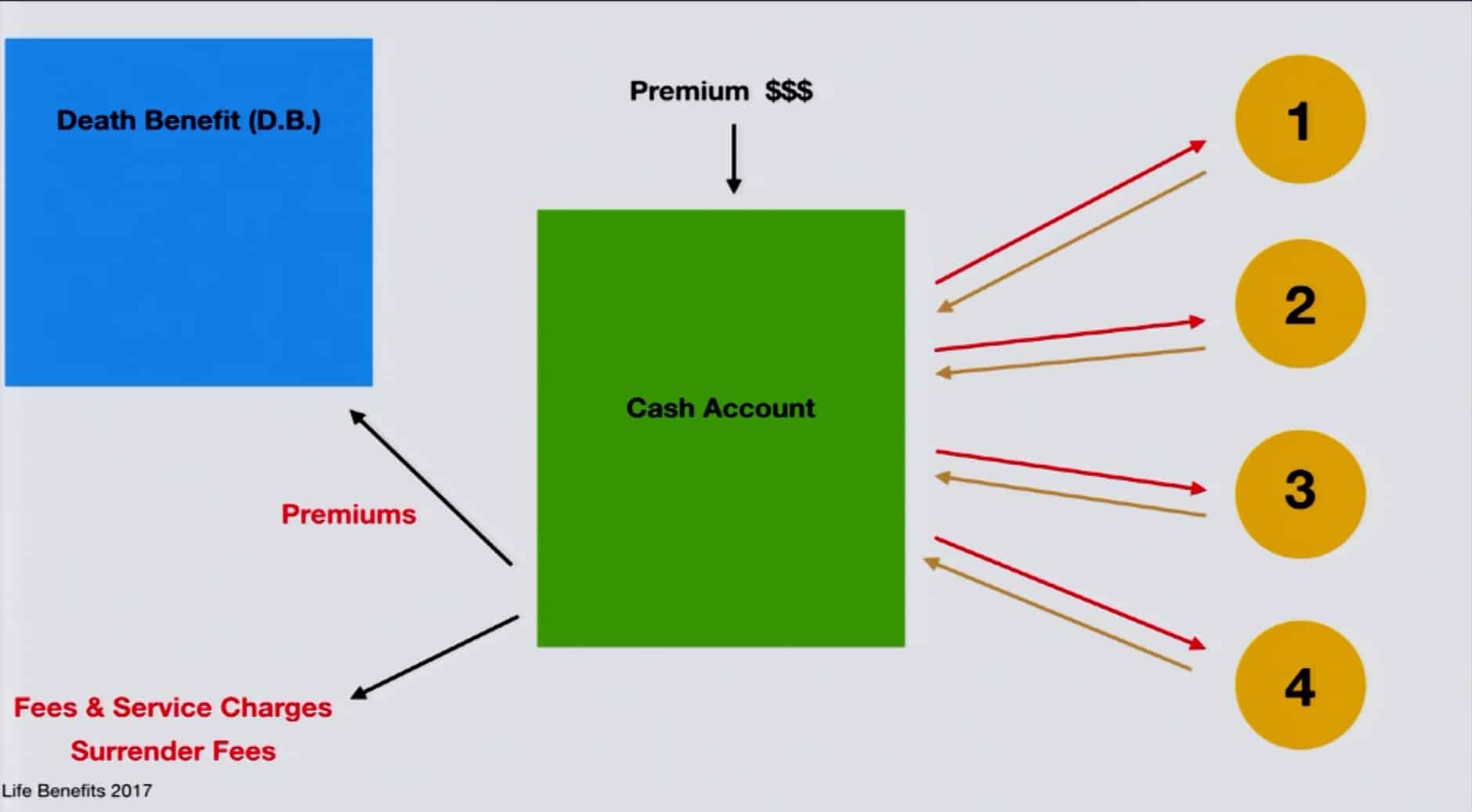

The purpose of Whole Life Insurance is to provide coverage for the insured during their entire lifetime. Whole Life Insurance is a consumer demanded product that offers more than just a death benefit by letting the policyholder build equity in the policy. OUTLINE: Cash Value Policy Loans Dividends Fees Do You Get both the Cash …

Continue reading “How Whole Life Insurance Works”

Read More...

Type: articles

Understanding Whole Life Insurance You’ll hear many arguments for and against whole life insurance. Many people wonder what whole life insurance truly is and if the benefits of a policy would help them. There are many different types of life insurance. In this article, we cover how participating whole life insurance works, its pros and …

Continue reading “What is Participating Whole Life Insurance”

Read More...

Type: videos

Whole Life, Universal Life, One Year Renewable Term, Level Premium Term

Read More...

Recap of Whole Life Insurance Participating Whole Life Insurance (PWLI) is a lifelong insurance policy where premiums are paid annually. This contract involves the policy owner and the insurance company, with the company guaranteeing cash value growth during the insured’s lifetime and a specific death benefit to beneficiaries upon the insured’s passing. Additionally, the insurance …

Continue reading “Whole Life Insurance for Real Estate Investors”

Read More...

Type: post

TABLE OF CONTENTS: Liquidity in life insurance Can life insurance be categorized as a liquid asset? Life insurance varieties that provide liquidity Integrating liquidity into a term life insurance contract Is a liquid life insurance policy a good choice? Frequently Asked Questions KEY POINTS Liquidity in Life Insurance: Liquidity denotes how easily cash can be …

Continue reading “Liquidity In Life Insurance”

Read More...Type: articles

Life insurance is an essential financial tool that provides protection and financial security to your loved ones in the event of your death. It’s a contractual agreement between an individual and an insurance company, wherein the insurer promises to pay a designated beneficiary (or beneficiaries) a sum of money upon the insured person’s death. …

Continue reading “How Many Life Insurance Policies Can You Own?”

Read More...Type: articles

Introduction The cash surrender value of life insurance is the amount of money the insurance company would reimburse a policyholder if the life insurance policy is surrendered before the insured dies. Gaining an understanding of what cash surrender value of life insurance is, and what the cash value can be used for while a policyholder …

Continue reading “What is Cash Surrender Value of Life Insurance?”

Read More...