702-660-7000

702-660-7000

Indexed Universal Life (IUL) insurance is all the rave these days. The speculative component, though not guaranteed, is attractive to many consumers. While the commissions earned on these products are attractive to the agents.

“They say” IUL is a better buy and Participating Whole Life Insurance (PWLI) costs too much. So, let’s look and see…

An IUL illustration on a 25-year-old preferred male paying $4,070 annually recently came across our desk. By age 80 this policyholder will have paid about $0.21 for every $1 of guaranteed coverage in this IUL policy.

In comparison, a PWLI illustration with a $4,070 annual premium only requires about $0.11 to be paid for every $1 of guaranteed coverage by age 80. This means the IUL policy costs 90.91% more than the PWLI policy by age 80.

Conclusion: IUL costs more than PWLI due to the increasing cost of insurance the policy is built upon.

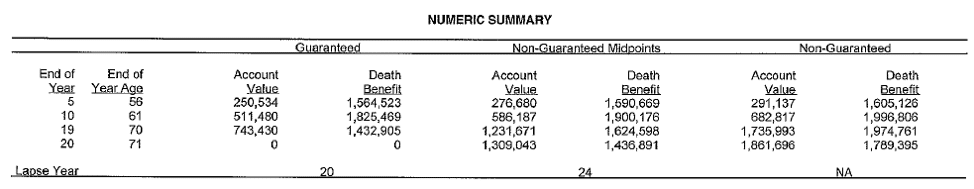

Another IUL illustration with premiums of $5,000 per month also crossed our desk. This IUL illustration was on a Preferred Plus 51-year-old male and it looked like this:

Nineteen years later, by age 70, this policyholder will have paid $1,140,000 ($60,000 x 19) in premiums and have $743,000 of guaranteed surrender value (see “Account Value” in above chart). Death benefit is guaranteed to be $1,432,905 and may reach $1,789,395, if the policyholder pays more than $5,000 per month OR if the projected returns implied in the non-guaranteed assumptions are met. If these assumed returns are 50% less than what has been assumed (mid-point projections) and additional premiums are not paid, the policy will lapse when the policyholder is 71 with nothing to show for the $1,140,000 of premiums that have been paid.

Nineteen years later, by age 70, this policyholder will have paid $1,140,000 ($60,000 x 19) in premiums and have $743,000 of guaranteed surrender value (see “Account Value” in above chart). Death benefit is guaranteed to be $1,432,905 and may reach $1,789,395, if the policyholder pays more than $5,000 per month OR if the projected returns implied in the non-guaranteed assumptions are met. If these assumed returns are 50% less than what has been assumed (mid-point projections) and additional premiums are not paid, the policy will lapse when the policyholder is 71 with nothing to show for the $1,140,000 of premiums that have been paid.

The cost of insurance for this IUL by age 70 has reached about $0.79 for every $1 of guaranteed death benefit.

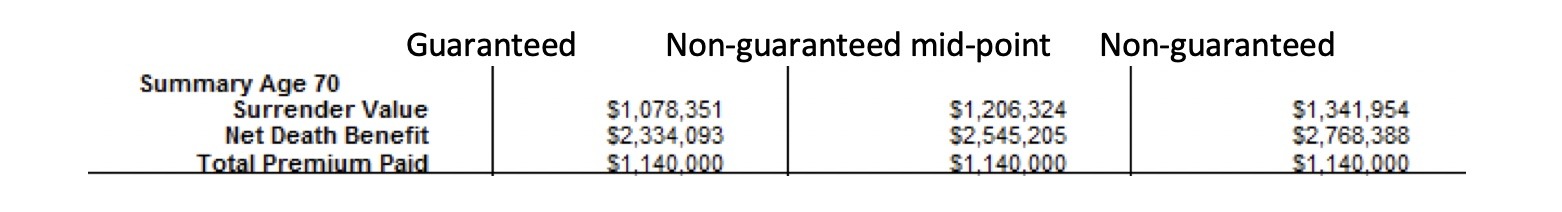

Running a comparative PWLI illustration with an identical $5,000 per month premium resulted in $1,078,351 of surrender value by age 70 ($335,351 more than the IUL illustration.) The guaranteed death benefit is $2,334,093, compared to the guaranteed IUL death benefit of $1,432,905. And the PWLI policy could be reduced to $2,151,211 of coverage at this time, requiring no more premiums from here on out and still have the guaranteed cash values rise annually until they equal the reduced guaranteed death benefit of $2,151,211.

Running a comparative PWLI illustration with an identical $5,000 per month premium resulted in $1,078,351 of surrender value by age 70 ($335,351 more than the IUL illustration.) The guaranteed death benefit is $2,334,093, compared to the guaranteed IUL death benefit of $1,432,905. And the PWLI policy could be reduced to $2,151,211 of coverage at this time, requiring no more premiums from here on out and still have the guaranteed cash values rise annually until they equal the reduced guaranteed death benefit of $2,151,211.

The cost of insurance by age 70 would only be $0.49 for every $1 of guaranteed death benefit, meaning the IUL cost 61.22% more than the PWLI for every $1 of coverage at this point in the contract.

Interestingly, the non-guaranteed death benefit of the PWLI illustration is $2,768,388 at age 70, which is $978,993 more than what is illustrated in the IUL illustration at age 70 ($1,789,395.)

Conclusion: If you want to pay less for your insurance, and have guaranteed coverage for your entire life, buy participating whole life insurance.

If you need to see a comparative quote on life insurance, call us at 702-660-7000. We could save you money!

Dr. Tomas P. McFie

Dr. Tomas P. McFie

Most Americans depend on Social Security for retirement income. Even when people think they’re saving money, taxes, fees, investment losses and market volatility take most of their money away. Tom McFie is the founder of McFie Insurance which helps people keep more of the money they make, so they can have financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.