702-660-7000

702-660-7000

Investing your hard earned money is important if you want to avoid the pitfalls of inflation, taxation and market volatility. And it doesn’t take a rocket scientist to realize that if you don’t know where you can go wrong you may lose quite a bit of money discovering what can go wrong. And you certainly don’t want to discover this when you’re fixing to retire.

The biggest financial fear people face today is “Will I out live the money that I have invested for retirement?” And the second biggest worry is very similar. “What will it cost my retirement if I need long term care?” Fortunately, the answers to both of these questions can easily be assured if you are aware of the the three top dangers when it comes to investing your money today.

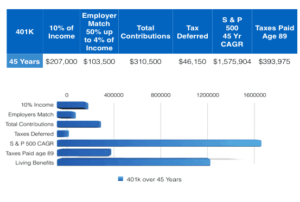

The first danger is that most Americans believe that some sort of qualified plan like a 401k or IRA is the best deterrent against running out of money in retirement. Pitifully, if you are relying on your 401k or IRA you’re in for a rude awakening. Socking away 10% of your monthly income into a qualified plan from the time you are 25 until you are 70 will only defer $46,150 of income tax.[i] And when you start taking distributions from your qualified money in retirement you will have to repay the IRS for all those years you deferred your income taxes. This means you will pay Uncle Sam a whopping $393,975 in taxes from the time you are 70 until you are 89 and then you will be flat broke. That is, IF YOU ONLY NEED $56,000 a year to live on. If you need more than $56,000 a year to live on your taxes will naturally be greater and you will run out of money sooner than later.

Which brings us to the second danger. What happens if you NEED MORE than $56,000 a year? For instance:

Which brings us to the second danger. What happens if you NEED MORE than $56,000 a year? For instance:

Let’s face it. Things happen and when we are not prepared for them to happen the cost of these unplanned events can spell financial disaster. Nearly 1 out of 2 people over age 40 realize that almost everyone is likely to require long-term care but less than a quarter of these same people think they will need any care at all.[ii] Long term care insurance, obviously then, is a must. And it becomes very important for you to know that not all long term care insurance coverage is the same.

You must make sure your long term care insurance premiums are fixed for life or you could still run out of money simply by paying the insurance premiums when you need long term care or assistance.

The last danger is underestimating the safety, security and sustainability that guaranteed participating whole life insurance contracts can provide you in retirement. That’s right. Life insurance isn’t merely for when you die. As they say, “the devil is in the details” and the data is in: Life insurance properly planned and paid for can increase your retirement cash flow by 50%.[iii]

All this adds up to the fact that you don’t have to worry about running out of money in retirement if you plan and invest wisely and properly today.

Safety, security and sustainability. These are the most important factors to consider when planning for retirement. And you don’t need to wait until you are 40 or 45 to begin planning. Indeed, the sooner you start planning the better off you will be.

[i] Using average annual income by age from the Department of US Labor and Statistics

[ii] http://www.pbs.org/newshour/rundown/as-boomers-age-most-woefully-unprepared-for-long-term-care/

[iii] Optimizing Retirement Income by Combing Actuarial Science and Investments, Wade D. Pfau, Ph.D., CFA