702-660-7000

702-660-7000

Note: McFie Insurance its agents, and representatives are not authorized to give investment, legal or tax advice. This article is purely for educational/information purposes.

A fiduciary is a person or entity to whom property or power is entrusted for the benefit of the principal/client or other beneficiaries.i

Common examples of fiduciary capacity include:

By law, a fiduciary is supposed to put their clients’ interests ahead of their own interests, and if they do not, the law supports legal recourse for the client or beneficiaries whose interest(s) were violated.ii

Today, the term “fiduciary” is probably most used in connection with an advisor providing financial planning services or managing assets for clients. The law requires such an advisor to carry out a fiduciary duty to the client.iii

Among other things, this fiduciary duty requires a financial advisor to:

In theory this standard sounds like simple common sense and living by the golden rule. In practice, it is obvious that not all human beings live by the Golden Rule.

Financial professionals who do not have a fiduciary duty to their clients usually have a suitability obligation.viii Stockbrokers and most life insurance agents are good examples of financial professionals who operate under a suitability obligation.

Professionals under a suitability obligation still must make a reasonable effort to ensure recommendations will benefit a client.ix

Beyond these restrictions, government regulation is lighter on the suitability standard, and it is up to a client to perform due diligence and look after their own best interests, understanding that conflicts of interest may exist.

Professionals under a fiduciary standard have greater regulations and oversight in an attempt to minimize conflicts of interest and to disclose any which remain.

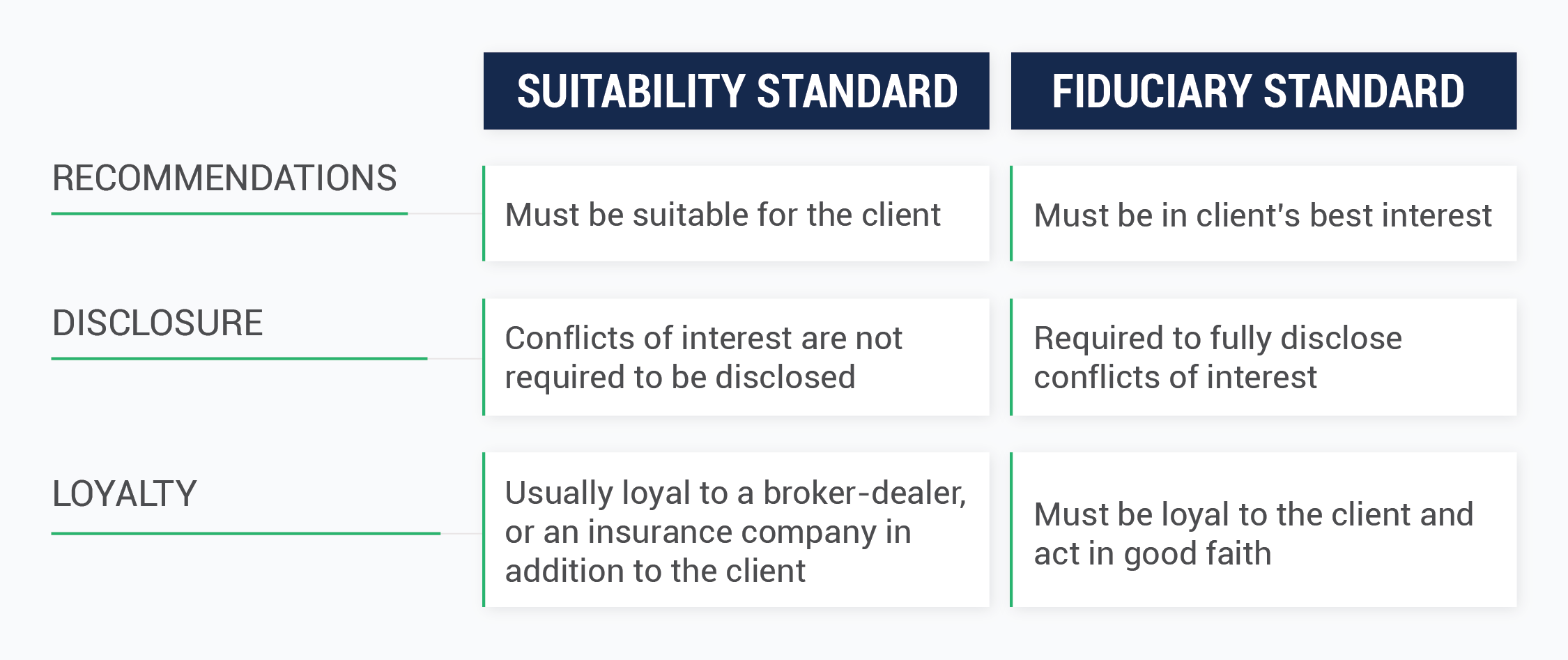

Here’s a quick list of some differences between these standards in 3 areas:

See footnotes for chart referencex

See footnotes for chart referencex

Some conflicts of interest are easily eliminated and enforced such as providing that fiduciary advisors are not allowed to buy securities for their own accounts prior to buying them for clients. Others such as commissions an advisor representative who is also an agent may receive, or commissions received for the sale of life insurance products are disclosed.xi

When it comes to exercising a duty of care and loyalty to a client while selecting, managing and monitoring investments, we run into some more subjective aspects which can be difficult to enforce.

Risk tolerance is one such area of subjectivity. In an effort to understand how much risk a client is willing to assume, a fiduciary advisor will ask a client questions about risk tolerance.

Risk tolerance profiles can vary considerably from a few simple questions which try to cover a large base, to comprehensive questionnaires. Based on the client’s answers, an advisor is supposed to selects appropriate investment options.

Reality suggests that many advisors have already chosen a handful of investment options and merely use answers from risk tolerance questions to pigeonhole clients into these pre-selected options. Whether a risk tolerance questionnaire you complete accurately defines your goals or not is good question.xii

Fiduciary advisors are supposed to get to know their clients and understand what they’re trying to accomplish, but this is something that can never be completely enforced. Relationships are a two-way street and simply cannot be forced from either direction for productive results.

Transparency is also quite subjective. It has been said that “for the most part, financial professionals bound by fiduciary duty tend to be more transparent.”xiii

It cannot be stated unequivocally that “financial professionals bound by fiduciary duty are more transparent”, because it is simply not possible to eradicate the human element.xiv

How do you measure and enforce transparency beyond objective disclosures?

In our experience, strong proponents of the fiduciary standard often downplay suitability and make it seem that professionals operating under a suitability standard are “just waiting to sell you out.” While this can be true of some people, it doesn’t have to be this way.

A professional who operates under a suitability obligation may believe in going further than their legal requirements to make sure they are always looking out for their client’s best interest. A professional operating under a fiduciary standard is required to meet certain legal obligations and to act in the client’s best interest.xv

Although a fiduciary standard is not perfect, it can serve to eliminate some obvious conflicts of interest and serve as a guide for professional behavior.

The extra oversight to enforce fiduciary regulations does carry a costxvi which is passed on in the form of higher planning or management fees; thus, it makes sense that a fiduciary standard should not be applied to all financial professionals.xvii

Even if we admire the spirit of some fiduciary regulations and oversight, the question remains of whether the extra cost of all the regulations is worth the added benefits?

After all, financial scams still exist – even ones peddled by fiduciary advisors.xviii In the end, you can certainly delegate some decisions to advisors, but we don’t think it is ever smart to completely abdicate responsibility and oversight of your financial affairs, even to an advisor with a fiduciary duty.

The easiest way is to know if your advisor is a fiduciary is to ask them. Some advisors operate under both suitability and fiduciary standards, depending on what they are doing. They should be able to explain how they operate and clearly explain what standards they are operating under and when.

From here, you can go check the consistency of their information as far as examinations, professional designations, etc. on FINRA’s BrokerCheck website and/or the SEC’s Investment Advisor Public Disclosure website.

You should find a profile on one of these two sites because individual advisors serving the general public are required to register:

Links to further resources and the history of any investment-related licensing information, arbitrations, complaints and sometimes disciplinary actions can also be found.

Note: Registration with any governing authority is not an endorsement or approval of a particular advisor in any way, but lack of registration is certainly a red flag. Authorities review the background of advisors as they register, and on an ongoing basis trying to eliminate bad actors such as people who have stolen money or performed other egregious crimes.

Next, you will likely want to research the meaning of various examinations or professional designations. For example:

Keep in mind, that just because an advisor is registered doesn’t mean they are fully capable of performing the purpose for which you are engaging them.

To avoid, unintended consequences it’s always important to do your own due diligence and educate yourself enough to know, as far as possible, an advisor you are choosing is capable and registered with the proper authorities.

Robo-advisors who hold a registration with the SEC are currently considered fiduciaries. According to the SEC they are advisors subject to the fiduciary obligations of the Investment Advisers Act of 1940.

It’s interesting to note the fiduciary duty of an investment advisor to clients is not actually spelled out in the Investment Advisers Act of 1940 but was “interpreted into law” later by the U.S. Supreme Court in the 1963 case SEC vs. Capital Gains Research Bureau.xxiv

This is a question which is seeing quite a bit of recent debate in the financial industry. People interested in exactly what is a fiduciary, should pay attention.

Anti-robos argue that robo-advisors are operating as unregistered mutual funds and should register as mutual funds under the Investment Advisers Act of 1940.xxv

We feel it is obvious that software capabilities alone do not allow a full understanding of client objectives or best interest through simple risk tolerance questions.

Some robo-advisors can have extensive potential conflicts of interest especially as they are bought-out by larger financial firms.xxvi These conflicts can always be disclosed, but few clients will really read through a growing mountain of disclosures and would understand exactly when they apply.

Pro-robos argue that robo-advisors do meet fiduciary standards and provide broader and more affordable access to investments.xxvii

Both sides have good points. It is likely that a new type of registration may be created for robo-advisors in the near future, which does not fully meet a fiduciary standard, nor requires registration as a mutual fund.xxviii

Questions which will likely be considered by regulators as they consider different types of robo-advisors include:

For now, robo-advisors are regulated as fiduciaries. Whatever changes may be on the way, we believe robo-advisors certainly do not eliminate the need for people to be educated and take an active role in managing their own money.

When you choose an advisor, it is important to ask yourself why you are choosing them? Keep this in mind as you consider what advisors to choose and make sure your advisors are always adding value corresponding to what you actually need and want.

Resource: It may help to checkout this article titled: What does a Financial Advisor Do?

Referrals are often great options because they come recommended from someone you already trust. Some websites also manage lists of financial advisors based on different criteria such as:

Questions you may want to ask during an interview process with an advisor include:

When selecting an advisor to manage your assets, here are some additional questions to consider:

The current trend in the United States is to use a fiduciary advisor whenever possible because they are supposed to lookout for your best interests. While fiduciary advisors can certainly offer unique benefits in the right circumstances, they may also come with a cost.

If you need an advisor to perform specific financial planning, or to manage investments over time, a fiduciary advisor can be a great solution.

Sometimes information for which a fiduciary planner would charge, might be available at no cost from a non-fiduciary advisor, so there are cases where it does not make sense to use a fiduciary.xxix

If you are looking for a life insurance policy, a fiduciary advisor may want to run calculations and planning around a policy which would add to the overall cost of obtaining such a policy. Sometimes this is necessary, but if you know the life insurance will improve your financial situation, we believe detailed calculations to demonstrate the fact may not be needed, and you could contact an insurance agent directly.

Some life insurance agencies (including McFie Insurance) can provide limited what-if scenario calculations, which are incidental to the sale or service of a policy, at no cost. If we can’t help you, maybe we can refer you to someone who can help. Request a Strategy Session or call 702-660-7000 to talk with the McFie InsuranceTeam.

If you’re an investor who knows what type of trading strategy you want to implement, and are willing to manage your own investments, or you want to purchase specific stocks or options, we think it is likely you can get a great deal by going straight to a broker who might operate under the suitability standard, rather than a fiduciary advisor who would take a flat fee or a percentage of assets under management.

Management fees are worth special consideration. They may seem small at the time, but they can destroy a lot of compounding potential.xxx Extra effort spent to minimize management fees when selecting an advisor will almost always pay off later.

Fiduciary advisors, life insurance agents and stockbrokers all have their place in the American financial system. Fiduciary advisors are supposed to always look out for the best interest of their clients, but this standard may carry an additional cost and the spirit of an ideal standard is not wholly possible to enforce.

No type of advisor or agent can ever replace the advantage of a client who gains education and understanding to be pro-actively involved in the management and oversight of their own money because “no one will ever take care of your money the way you do.”

At McFie Insurance, we design and sell life insurance for the protection, guarantees and living benefits.

We also provide financial education through this website and in talking with people, because when people know what’s happening, they usually find ways to minimize taxes, reduce fees and cut losses to keep more of the money they make and growth wealth.

Talk to the McFie InsuranceTeam at 702-660-7000.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the Wealth Talks podcast.

At age 14 I started developing spreadsheet models and software systems to help my Dad share financial concepts with clients.

Skipped college at 17 recognizing the overinflated value and prices of most college degrees and built more financial software instead (see MoneyTools.net). Still a strong advocate of higher education without going to college. I enjoy making financial strategies clear and working through the numbers to prove results you can count upon.

Note: Loans and withdrawals from life insurance can cause adverse tax consequences, penalties and may cause your policy to lapse. Insurance products are backed by the claims paying ability of the issuing insurance company and are not FDIC insured. McFie Insurance its agents, and representatives are not authorized to give investment, legal or tax advice.

Footnotes:

ihttps://www.investopedia.com/terms/f/fiduciary.asp, https://definitions.uslegal.com/f/fiduciary/

iihttps://www.legalmatch.com/law-library/article/suing-a-business-for-breach-of-fiduciary-duty.html

iiiIbid

ivhttps://www.investopedia.com/terms/f/fiduciary.asp

vIbid

viIbid

viihttps://www.investmentadviser.org/about/standards-practice-duty

viiihttps://tritonfinancialgroup.com/fiduciary-standard-vs-suitability-rule/

ixhttps://www.whitesecuritieslaw.com/finra-cracks-down-excessive-trading/ , https://www.sec.gov/oiea/investor-alerts-bulletins/ia_excessivetrading.html, https://www.sec.gov/info/smallbus/secg/regulation-best-interest

xhttps://smartasset.com/financial-advisor/what-is-fiduciary-financial-advisor

xihttps://www.aliesq.com/articles/2020-fiduciary-rule-regulation-best-interests-and-suitability-standards-trumps-rollback-of-obama-investor-protections

xiihttps://www.kitces.com/blog/risk-tolerance-questionnaire-and-risk-profiling-problems-for-financial-advisors-planplus-study/

xiiihttps://smartasset.com/financial-advisor/what-is-fiduciary-financial-advisor

xivhttps://www.thestreet.com/personal-finance/education/do-financial-advisors-have-a-transparency-problem-your-client-may-think-so-14204723

xvhttps://www.hspplc.com/blog/2019/09/understand-a-fiduciary-financial-advisors-legal-responsibilities/

xvihttps://www.kiplinger.com/article/investing/t064-c032-s014-the-real-cost-of-the-fiduciary-rule.html

xviihttps://www.retirementstewardship.com/2016/04/05/financial-planneradviserbroker-fiduciary/ “Our biggest concerns are reduced access to advice for the lower end of the investor spectrum and higher costs for individuals.” ~ Andy Blocker, Executive Vice President of Public Policy and Advocacy at the Securities Industry and Financial Markets Association

xviiihttps://www.thinkadvisor.com/2020/09/03/firm-tied-to-woodbridge-ponzi-scheme-settles-with-sec/

xixhttps://www.investor.gov/introduction-investing/getting-started/working-investment-professional/investment-advisers-0, https://www.sec.gov/about/offices/oia/oia_investman/rplaze-042012.pdf

xxhttp://www.advisorsmagazine.com/trending/23759-is-your-advisor-a-fiduciary

xxiIbid

xxiiIbid

xxiiihttps://www.feeonlynetwork.com/how-to-tell-if-a-financial-advisor-is-a-fiduciary/

xxivhttps://www.sec.gov/divisions/investment/capitalgains1963.pdf

xxvhttps://papers.ssrn.com/sol3/papers.cfm?abstract_id=2658701

xxvihttps://www.financial-planning.com/news/new-sec-robo-advisor-guidance-spotlights-disclosure-client-communication xxviihttps://www.morganlewis.com/~/media/files/publication/outside%20publication/article/klass-perelman-evolution-of-advice-novdec2016.ashx

xxviiihttps://www.thinkadvisor.com/2017/01/30/can-a-robot-be-a-fiduciary/

xxixhttps://www.investopedia.com/articles/basics/04/022704.asp

xxxhttps://www.forbes.com/sites/robertberger/2016/12/19/the-dirty-little-secret-investment-advisors-dont-want-you-to-know/