702-660-7000

702-660-7000

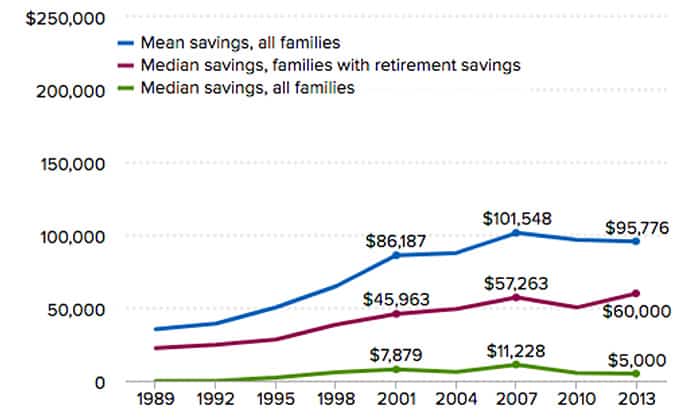

According to the most recent Marist poll,[i] the most annoying phrase for Americans, for the ninth straight year in a row, is “whatever.” Evidently “Que Sera, Sera, whatever will be, will be,’ is simply annoying to over one-third of the nation.[ii] Yet, according to the Economic Policy Institute “Nearly half of American families have a “whatever” attitude about savings because they have no savings at all.”[iii] Disturbingly the average savings across America is a mere $95,776. But even this amount of savings is unrealistic, because there are so many families that have no savings at all and an average savings calculation overlooks this fact. If we reflect on the median savings instead of the average savings we find that $5,000[iv] is the median savings for all American families and for those who have any savings at all the median savings is only a mere $60,000[v]. And that is a far cry from $95,776.

Robert Shiller, the Nobel Laureate and economics professor at Yale, clarifies that “Finance is not merely about money. It is about achieving our deepest goals and protecting the fruits of our labor. It is about stewardship and achieving the good society.” That is a far-reaching explanation of what finance really is but it demonstrates why focusing simply on the money is a futile practice, namely because finance involves so much more than merely money. Stewardship, you see, is not an occasional occupation but a full-time, all the time preoccupation. Concentrating on money can never provide you the security you are looking for. Only exercising good stewardship can provide that regardless of “whatever” anybody else might tell you. Solomon knew this when he wrote, “Cast but a glance at riches and they are gone, they will surely sprout wings and fly off to the sky like and eagle.”[vi] And still, most everybody will tell you that building a sustainable financial future requires that you focus on rate of returns, market trends, stock market analysis, employer contributions to 401k plans and deferring taxes. And all of these things simply deter you from really being focused on what really does matter and that is today. You can’t honestly expect to find the security you’re looking for by trusting in your investments because markets are too volatile. But by focusing on today and what you can do to become a better manager over what you have, you can.

Whatever anyone else might say, there is no better way to plan for your financial future than through saving part of what you are earning today. Good stewardship necessitates purposeful savings. If you earn $1 determine what portion of that $1 you will set aside, (not invest because investing involves risk of losing it all) but saved. A good farmer sets aside a portion of the seed from his harvest so that he will have the seed necessary to plant. That is because he intends to have a harvest next season as well. But there will be no next season harvest if he doesn’t set the seed aside today, from his current harvest, to plant for the next one.

Being able to depend on the seed money set aside becomes vital to your financial future. It is as Robert Shiller states, “protecting the fruits of our labor.” Without this kind of protection, we are forced to start each season of life all over again from scratch. And for “whatever” reason, many people do exactly that, start each season of life again from scratch rather than have the savings of the past there for assistance. Starting each season of life over again from scratch is the result of:

“Whatever” others might think of participating whole life insurance, these facts remain. Participating whole life insurance provides;

These facts are what make owning participating whole life insurance the tool of choice of good stewardship. It protects the fruit of your labors, helps you fulfill your deepest goals and paves the way for the good society that we all desire.

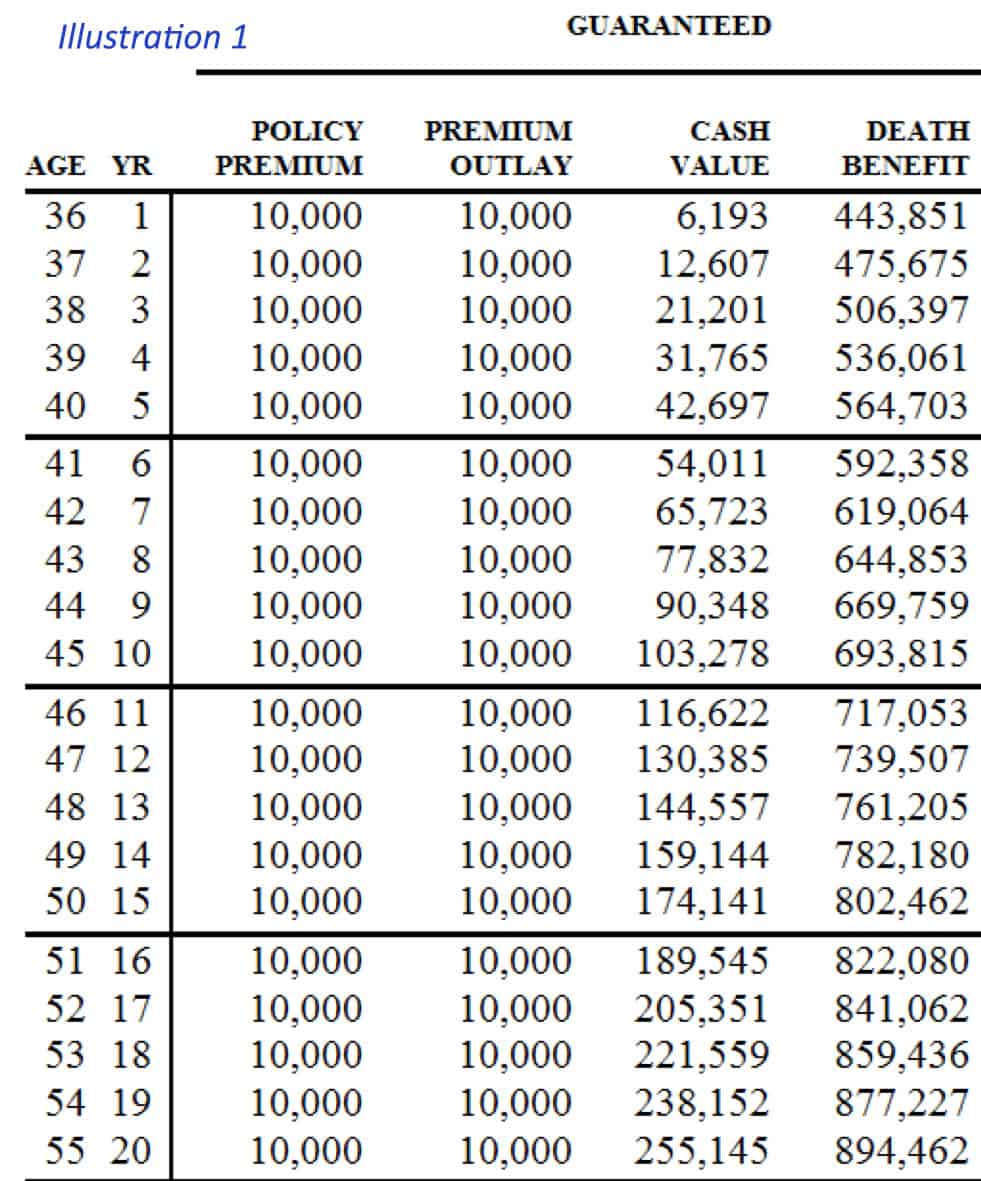

Unlike investing, participating whole life insurance provides a guaranteed return for you and you don’t have to die to benefit from the guaranteed return. Granted there will be a higher return on the savings you have used to pay premiums when you die, but you don’t have to die to get more from your participating whole life insurance than what you have used of your savings to pay the premiums. Observe in Illustration 1 that in year 10 the cash value of this policy is $3,278 more than what has been paid in premiums. That is due to the guarantee the life insurance company provides to the client who is purchasing this policy. And because of this guarantee, there is really no cost to the owner for this life insurance once the cash value becomes greater than the premiums paid for it.

Unlike investing, participating whole life insurance provides a guaranteed return for you and you don’t have to die to benefit from the guaranteed return. Granted there will be a higher return on the savings you have used to pay premiums when you die, but you don’t have to die to get more from your participating whole life insurance than what you have used of your savings to pay the premiums. Observe in Illustration 1 that in year 10 the cash value of this policy is $3,278 more than what has been paid in premiums. That is due to the guarantee the life insurance company provides to the client who is purchasing this policy. And because of this guarantee, there is really no cost to the owner for this life insurance once the cash value becomes greater than the premiums paid for it.

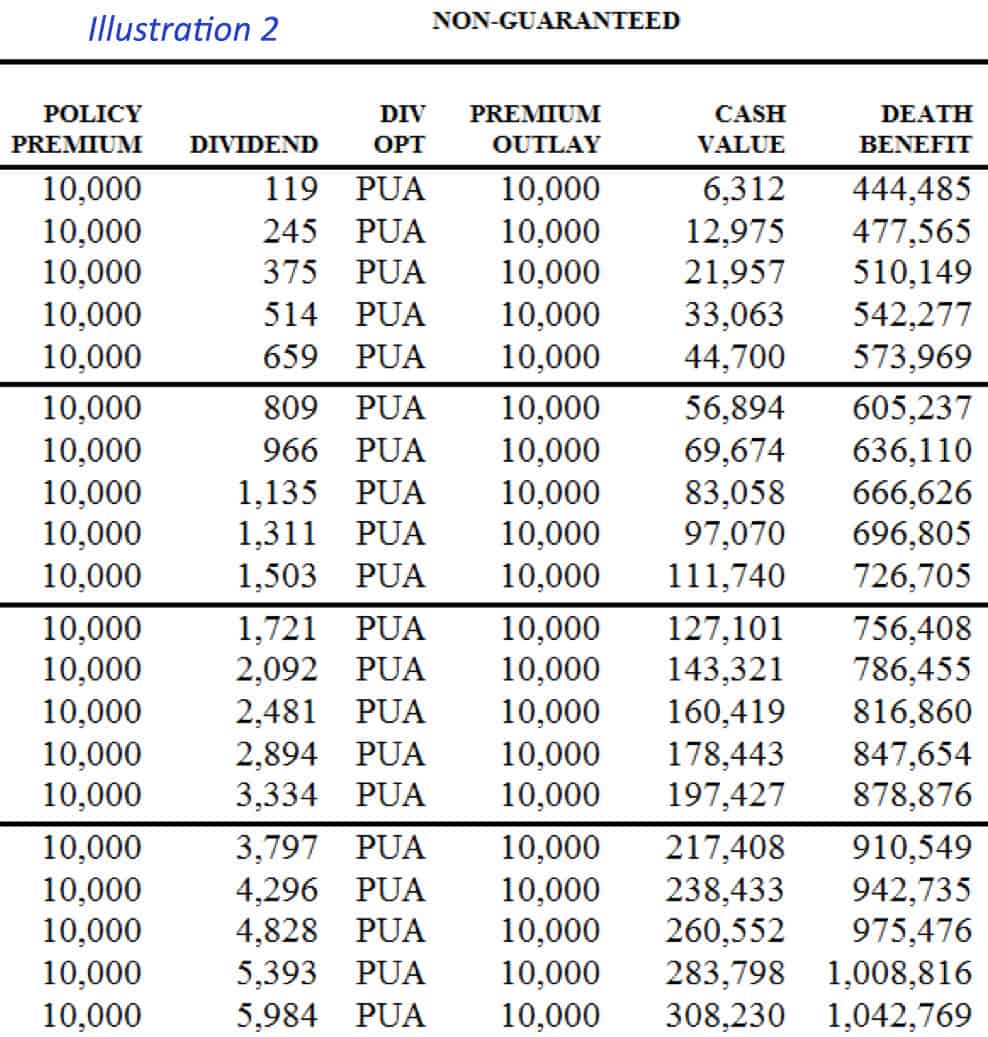

Or consider the fact that you can still receive this guaranteed return plus share in the dividends which the insurance company creates as they invest your premiums dollars (see Illustration 2.) That means that by year 10 you could have $11,740 more than what you have paid into the policy plus your life insurance coverage which has grown significantly since it was purchased 10 years earlier.

Or consider the fact that you can still receive this guaranteed return plus share in the dividends which the insurance company creates as they invest your premiums dollars (see Illustration 2.) That means that by year 10 you could have $11,740 more than what you have paid into the policy plus your life insurance coverage which has grown significantly since it was purchased 10 years earlier.

Besides this, there is the opportunity to use this cash value while you are still living and create even more savings by not having to pay interest to others. This is what bankers, corporations and business owners have understood about participating whole life insurance since the former Postmaster General, John Wanamaker, also the father of the department store, and the most insured person in American at the time, used participating whole life insurance to guarantee an average to better than average return on his deposits and to provide him a way to save more money than he could have otherwise when he owned all that participating whole life insurance.

Yes, “whatever will be, will be” because the future is not ours to see. But there is a way to make sure that what you have saved today will be there for you to plant tomorrow. You don’t have to worry that it will have made itself wings and flown off like an eagle. And the biggest reason for this is because when we purchase participating whole life we are not profiting at the expense of somebody else’s loss. That is what speculation and gambling is really all about. With participating whole life insurance, the premiums provide the capital necessary to improve and create value and services for society creating the good society that Robert Shiller speaks about when he addresses the question of what finance is really all about. Purchasing participating whole life insurance allows the owner to “drive out the money changers” like the Lord did from the temple long ago, permitting you to keep more of what you make so that tomorrow’s harvest can be better than today because you no long have to deplete your savings to pay the money changers their fees, penalties and subscriptions. And that is the best way to plan for your financial future.

[i] http://www.wnd.com/2017/12/poll-fake-news-is-2nd-most-annoying-phrase/?cat_orig=diversions

[ii] Ibid

[iii] https://www.cnbc.com/2016/09/12/heres-how-much-the-average-american-family-has-saved-for-retirement.html

[iv] Ibid

[v] Ibid

[vi] Proverbs 23:5